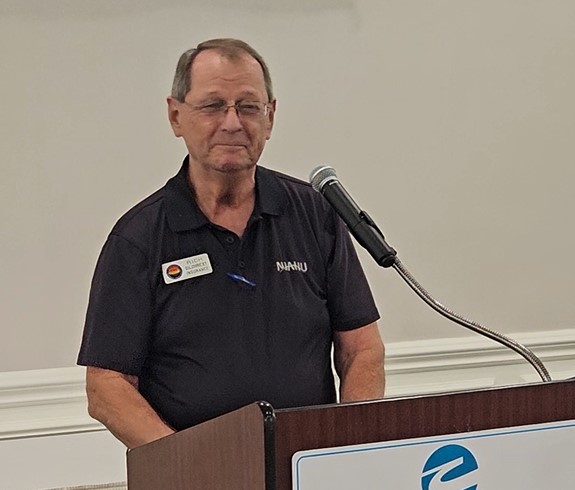

Rich Gilchrest from Capstone Insurance gave an insightful talk at a recent Ocean County Business Association (OCBA) lunch meeting, sharing his extensive experience in the insurance industry. With over 40 years in the business, Rich reflected on his journey from working for large corporations to becoming an independent broker specializing in employee benefits and medical insurance. In his talk, Rich provided valuable information on the evolution of health insurance, the impact of the Affordable Care Act, and his current focus on Medicare and small employer group programs. Below is a summary of the key points he discussed.

From Corporate Employee to Independent Broker

Rich began his career with Travelers Insurance in the early 1980s, working for the corporation for seven years. However, a surprise announcement at a Christmas party in 1982 changed the trajectory of his career. The company announced layoffs, and Rich found himself transporting colleagues back home after his company car keys were taken. This experience marked the end of his time as a corporate employee and the beginning of his journey as an independent insurance broker.

For the next 37 years, Rich was a partner in The Martin Agency, where he developed his expertise in commercial insurance. When The Martin Agency was sold, Rich transitioned to Capstone Insurance, where he continues to work as an outside independent broker, serving clients throughout New Jersey from his office in Pleasant Plains.

Specializing in Employee Benefits and Medical Insurance

Rich’s insurance expertise spans a wide range of services, but his primary focus has always been on commercial insurance, particularly employee benefits and medical insurance. He explained how offering employee benefits alongside property, liability, and workers’ compensation insurance was a natural fit for his clients. As companies sought comprehensive coverage, Rich’s ability to provide both commercial and employee-related insurance needs made him a trusted partner for businesses.

Over the years, Rich stayed at the forefront of health insurance, particularly during major legislative changes such as the implementation of the Affordable Care Act (ACA).

The Impact of the Affordable Care Act (ACA)

One of the pivotal moments in Rich’s career was his involvement with the New Jersey Association of Health Insurance Underwriters. Alongside 21 other representatives, Rich traveled to Washington, D.C., to lobby for New Jersey residents regarding the provisions in the ACA. His goal was to soften some of the policies that he believed would drive up insurance costs while maintaining the Act’s positive features, such as guaranteed coverage with no pre-existing condition exclusions.

While the ACA was initially touted as a cost-saving measure, with promises of a $2,000 reduction in premiums, the reality was far different. Rich explained that premiums rose significantly—by as much as $2,500 to $6,000—over the following years, making health insurance increasingly expensive for both individuals and businesses. To mitigate these rising costs, Rich began exploring alternative funding mechanisms, such as Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), higher deductible plans, and self-insurance options.

Navigating the Medicare Market

As his clients aged, Rich recognized a growing need to help individuals navigate the complexities of Medicare. About 15 years ago, he shifted part of his practice to focus on Medicare services. After completing the necessary training and becoming certified by the Centers for Medicare & Medicaid Services (CMS), Rich developed a thriving Medicare practice.

Rich explained the basic structure of Medicare:

- Part A covers hospitalization,

- Part B covers outpatient and physician services, and

- Part D covers prescription drugs.

He also discussed the importance of Medicare supplement plans, often referred to as “Gap programs.” These supplements act as a safety net, covering expenses that Medicare does not, such as co-pays and deductibles.

Serving the OCBA and Beyond

As Rich concluded his talk, he reflected on the relationships he has built over the years, especially within the OCBA. Many of his long-standing clients are OCBA members, and he values the loyalty and trust they have placed in him. His focus remains on providing comprehensive and affordable insurance solutions for small employer groups and individuals alike.

Rich’s 40 years of experience in the insurance industry, his commitment to his clients, and his deep understanding of evolving healthcare legislation have made him a trusted resource for businesses and individuals navigating the complexities of insurance.

If you have any questions or need assistance with your insurance needs, Rich Gilchrest and Capstone Insurance are here to help.